what is fit tax on paycheck

The Federal Insurance Contributions Act FICA is a federal law that requires employers to withhold three different types of employment taxes from their employees paychecks. Federal income tax withholding varies between employees.

Solved What Is The Purpose Of Extra Withholding Under The

Employers withhold FIT using either a percentage method bracket method or alternative method.

. The employee is responsible for this amount and the FIT tax is. Your net income gets calculated by removing all the deductions. For each child under 17 the taxpayer can receive a 2000 child tax credit per year.

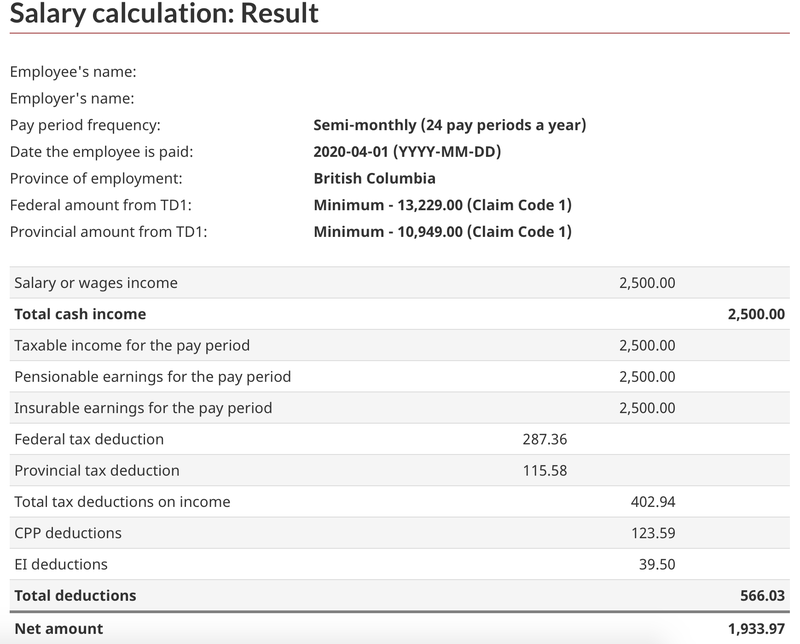

What is FICA tax. 1b Our employee is paid semi-monthly or 24 times per year. The amount of income tax your employer withholds from your regular pay depends on two things.

Wage bracket method and percentage method. In addition you need to calculate 22 Column D of the earnings that are over 44475 Column E. You can use the Tax.

This is the simpler method and it tells you the exact amount of money to withhold based on an employees taxable wages number of allowances marital status and payroll period. Estimated income tax 610 10 tax rate for taxable income of 6100 divided by 52 weeks 1173 per check Income tax is calculated based on IRS tax tables rules. These amounts are paid by both employees and employers.

FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. The information you give your employer on Form W4. If we add up the two tax amounts.

FIT on a pay stub stands for federal income tax. For 2022 employees will pay 62 in Social Security on the first 147000 of wages. However they dont include all taxes related to payroll.

The amount of income you earn. The IRS bases FITW on the total amount of taxable wages. Half of the total 765 is.

1a This is the same as gross wages so as we calculated before the amount is 208333. FICA tax includes a 62 Social Security tax and 145 Medicare tax on earnings. In 2021 only the first 142800 of earnings are.

These two taxes aka FICA taxes fund specific federal programs. Fit stands for Federal Income Tax Withheld. The government uses federal tax money to help the growth of the country and maintain its upkeep.

How many withholding allowances you claim. For employees withholding is the amount of federal income tax withheld from your paycheck. Some are income tax withholding.

If you withhold at the single rate or at the lower married rate. This tax will apply to any form of earning that sums up your income whether it comes for employment or capital gains. Your bracket depends on your taxable income.

This is the amount of money an employer needs to withhold from an employees income in order to pay taxes. TDI probably is some sort of state-level disability insurance payment eg. These items go on your income tax return as payments against your income tax liability.

10 12 22 24 32 35 and 37. The Federal Income Tax is a tax that the IRS Internal Revenue Services withholds from your paycheck. Specifically after each payroll you must Pay the federal income tax withholding from all employees Pay the FICA tax withholding from all employees and.

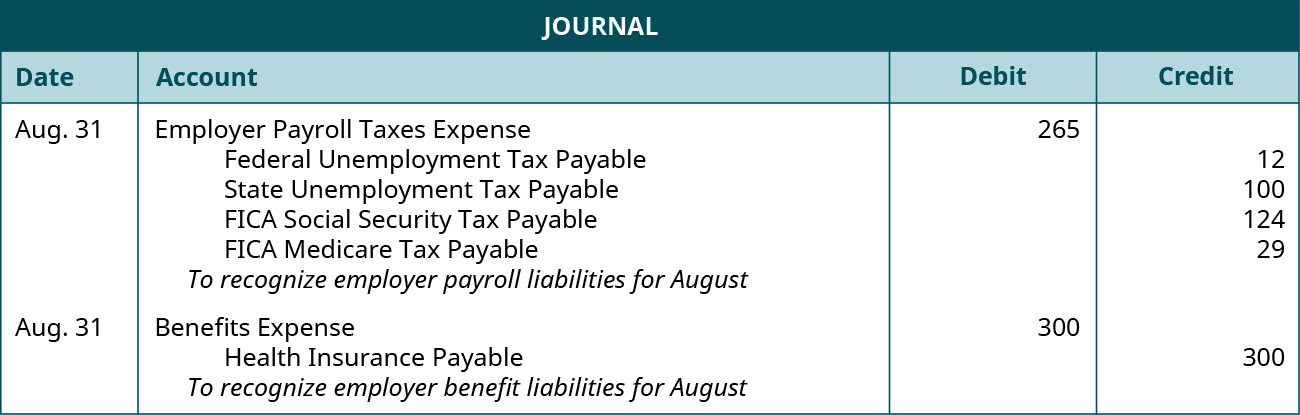

Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate. Dont Forget Employer Payroll Taxes. How to Figure Your Withholding Amount.

For help with your withholding you may use the Tax Withholding Estimator. Up to 32 cash back Using Worksheet 1 on page 5 we will determine how much federal income tax to withhold per pay period. There are two federal income tax withholding methods for use in 2021.

FIT deductions are typically one of the largest deductions on an earnings statement. The income ranges the rates apply to are called tax brackets. Federal Income Tax or FIT is the amount withheld from an employees paycheck which goes toward their Federal Income Tax liability at the end of the year.

How much is FIT tax. This is 548350 in FIT. FIT tax is calculated based on an employees Form W-4.

FIT Fed Income Tax SIT State Income Tax. Each allowance you. Income that falls within each bracket is.

69400 wages 44475 24925 in wages taxed at 22. FICA taxes are payroll taxes and they are a flat 62 social security tax and 145 medicare tax. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages.

4664 548350 1014750 total. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes.

4 rows The amount of FICA tax is 153 of the employees gross pay. These taxes include 124 percent of compensation in Social Security taxes and 29 percent of salary in Medicare taxes totaling 153 percent of each paycheck. FICA taxes are commonly called the payroll tax.

There are seven federal tax brackets for the 2021 tax year. In the United States federal income tax is determined by the Internal Revenue Service. Adjust the employees wage amount.

Federal Income Tax is withheld from your paycheck based on the amount of income you earn in each pay period. The amount you earn. Medicare is 145 for both employee and employer totaling a tax of 29.

The percentage method is based on the graduated federal tax rates 0 10 12 22 24 32 35 and 37 for individuals. The taxable wages for federal tax for withholding purposes is gotten by taking the gross pay and removing any exclusion that may exist for that employee. Federal income tax rates range from 10 to 37 and kick in at specific income thresholds.

Child tax credit3846 per check. The Federal Income Tax is progressive so the amount will vary based on the projected annual income paid by that employer to you. FICA taxes consist of Social Security and Medicare taxes.

You must make deposits with the IRS of the taxes withheld from employee pay for federal income taxes and FICA taxes and the amounts you owe as an employer.

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Different Types Of Payroll Deductions Gusto

Federal Income Tax Fit Payroll Tax Calculation Youtube

Mathematics For Work And Everyday Life

Understanding Your Paycheck Credit Com

Understanding Your Pay Statement Office Of Human Resources

What Are Employer Taxes And Employee Taxes Gusto

How To Calculate Payroll Taxes For Your Small Business The Blueprint

How To Calculate Payroll Taxes Methods Examples More

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

How To Do Payroll In Canada A Step By Step Guide The Blueprint

Payroll Tax Vs Income Tax What S The Difference The Blueprint

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Mathematics For Work And Everyday Life

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)